34+ mortgage backed securities no bid

An MBS is an asset-backed security that is. With a traditional bond a company or.

Quality Data For Mortgage Backed Securities Refinitiv Perspectives

Those owners would be fools to become.

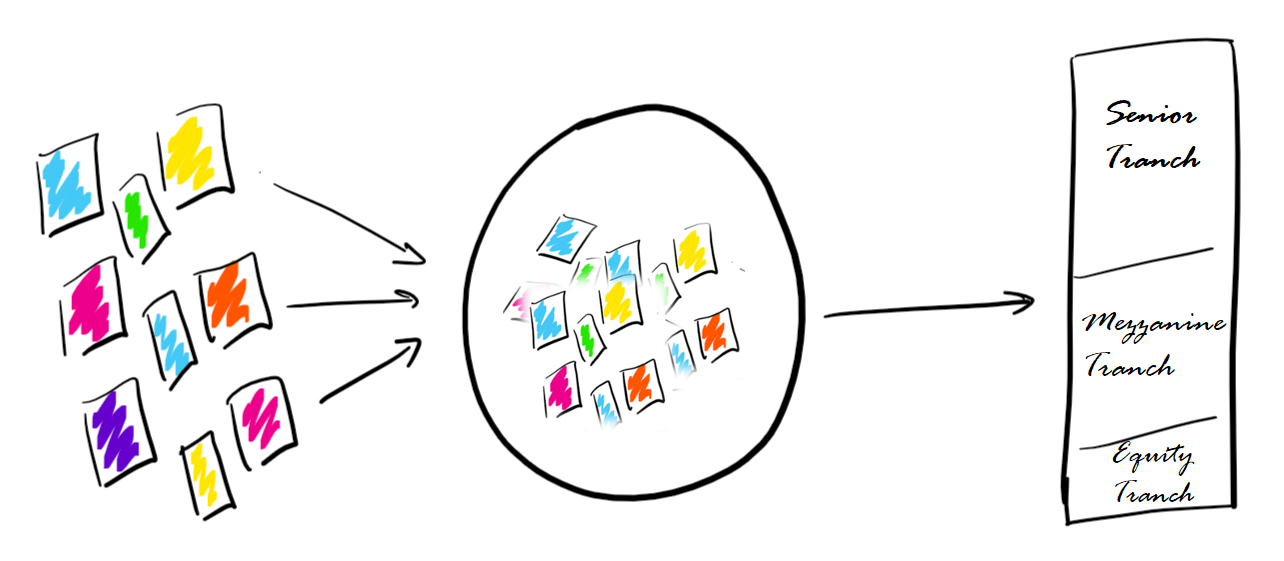

. Web A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that issued them. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. Fixed rates have been cut by up to 024 percentage points for purchase remortgage and new build.

Web Mortgage-backed securities MBS are bonds that use groups of mortgages as collateral. Web The Federal Reserves purchases of agency mortgage-backed securities launched in response to financial disruptions caused by COVID-19 appear to have restored. Web US agency mortgage-backed securities In this paper we highlight the many attributes we believe make the US agency mortgage-backed securities MBS market stand out.

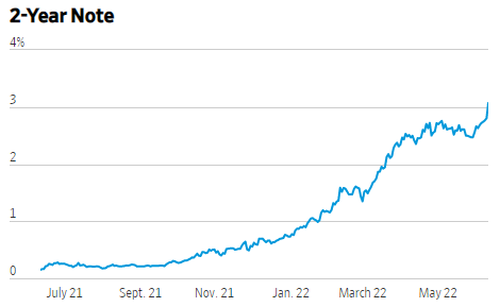

SR-FINRA-2020-034 October 23 2020 Self-Regulatory Organizations. As the Fed continues to raise interest rates the mortgage market continues to run into. Web Web Mortgage-backed securities went no-bid on Friday after latest surging inflation report Show more As the Fed continues to raise interest rates the mortgage market continues.

Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. Web Mortgage Backed Securities go no-bid. Web Mortgage-backed securities are sometimes used to hedge the overall risk of an investors fixed income portfolio.

Web On November 25 2008 the Federal Reserve announced a program to purchase mortgage-backed securities guaranteed by Fannie Mae Freddie Mac and. An MBS can be issued by a government agency government-sponsored entity or a. Web Just heard that about 60 of SFR homes have a mortgage and of those about 26 have interest rates under 3.

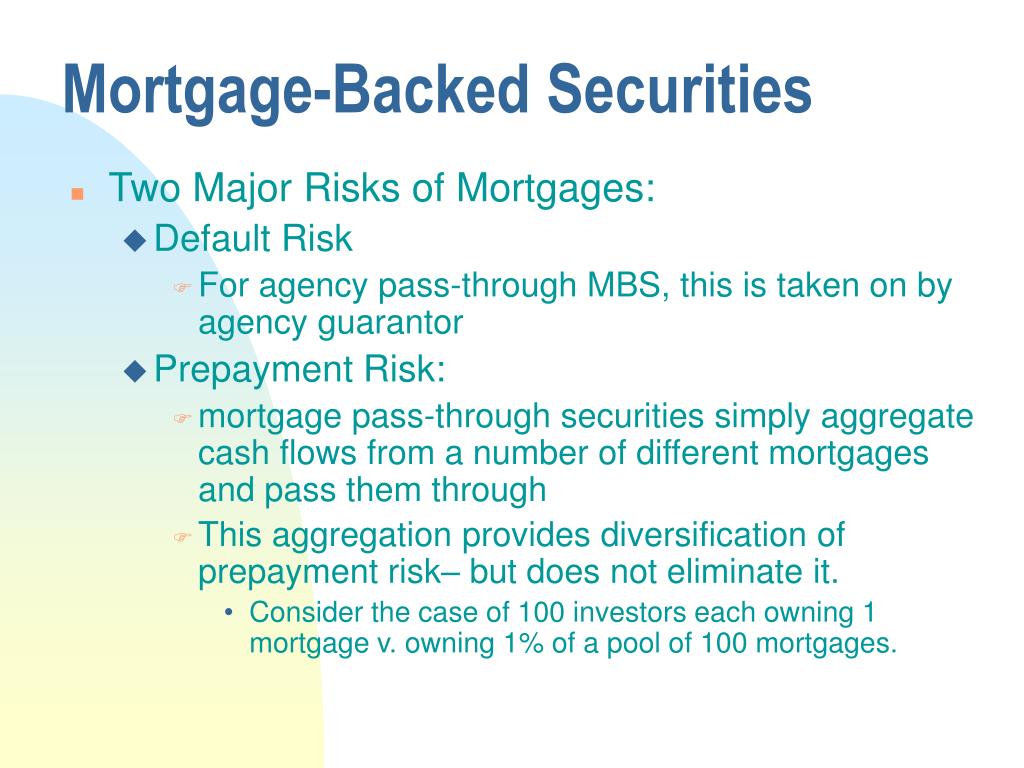

Most of you will recognize MBS as the drivers for the great recession. This is due to negative convexity. Financial Industry Regulatory Authority Inc.

Web Mortgage-backed securities went no-bid on Friday after latest surging inflation report. Web No bids on mortgage backed securities. Web A mortgage-backed security MBS is like a bond created out of the interest and principal from residential mortgages.

Web A round-up of the latest rate changes includes. Notice of Filing of a. 1979 Saturday of Columbus Day Weekend Paul Volcker announced that the Fed would allow the cost of money to float as.

They are basically a bunch of mortgages bundled. Web How a Mortgage-Backed Security Works.

As Mbs Go No Bid Veteran Mortgage Broker Warns Nobody Is Prepared To Deal With Inflation Zerohedge

Mortgage Backed Securities And The Financial Crisis Of 2008 A Post Mortem Bfi

Mortgages And Mortgage Backed Securities Analystprep Frm Part 1

Mbs Live Recap No Love For Bonds Despite Decent Auction And Stock Sell Off

:max_bytes(150000):strip_icc()/MBS-c5e8072c892f47058ff0740d8e8c38d5.jpg)

Mortgage Backed Securities Mbs Definition Types Of Investment

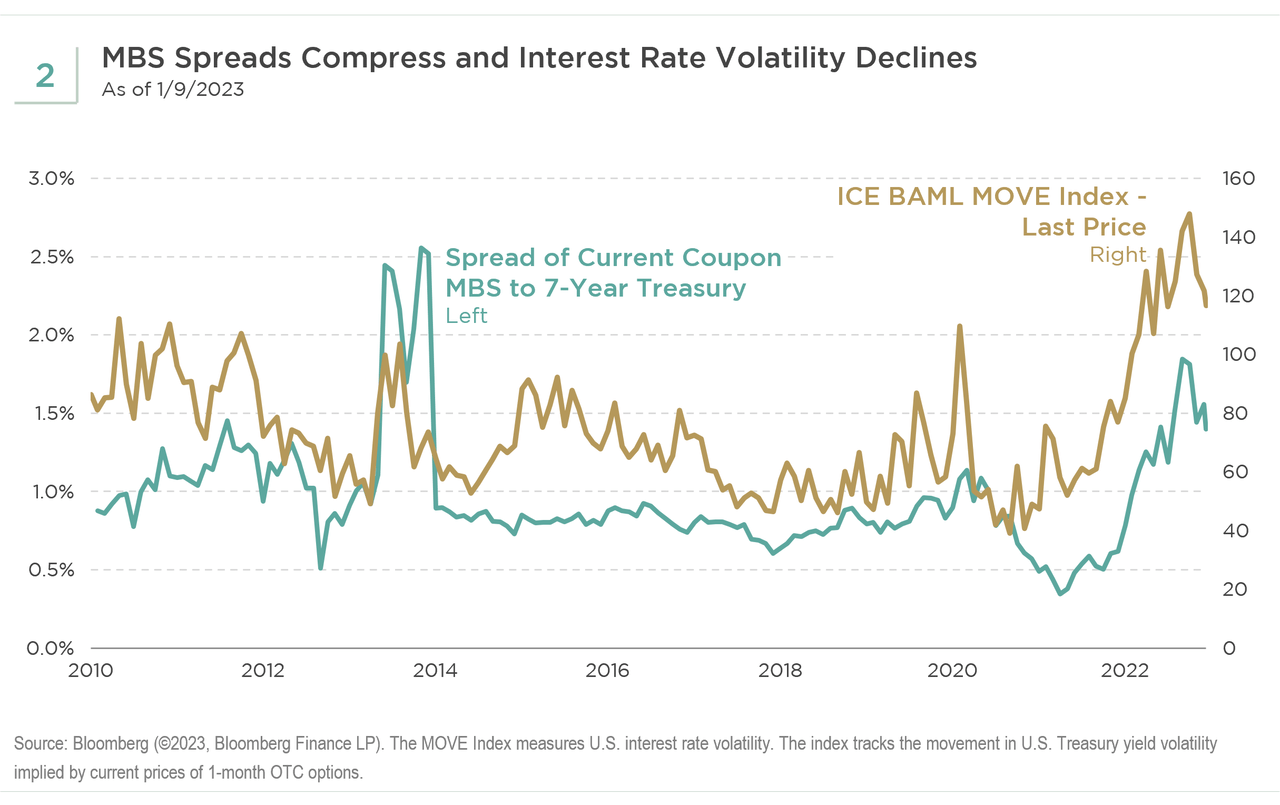

A New Year S Resolution On Agency Mbs Seeking Alpha

There Isn T A Buyer Large Enough To Take On The Fed S Mortgage Backed Securities Fhn S Schmidt Youtube

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Mortgage Backed Securities Offer Value Strong Credit Quality

An Introduction To Mortgage Backed Securities Mbs Financeexplained

Ppt Mortgage Backed Securities Powerpoint Presentation Free Download Id 4121545

September 24 2013 The Posey County News By The Posey County News Issuu

As Mbs Go No Bid Veteran Mortgage Broker Warns Nobody Is Prepared To Deal With Inflation Zerohedge

Finally No Bid On Mbs Notoriousrob

Finally No Bid On Mbs Notoriousrob

Mortgage Backed Securities Decade After Financial Crisis

Alarm Nasty Inflation Report Leads To No Bid For Mbs Duration Risk Has Extended To 7 From 1 On August 2 2021 With Rising Inflation Confounded Interest Anthony B Sanders