Tax bracket calculator 2020

It can be used for the 201314 to 202122 income years. Our tax refund calculator will show you how.

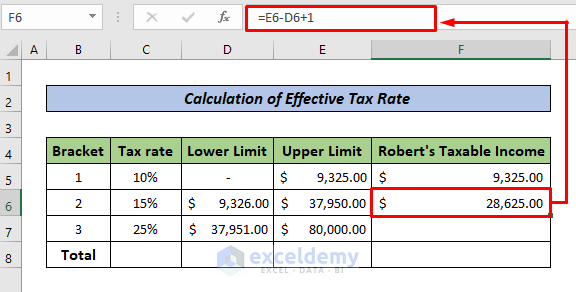

How To Calculate Federal Tax Rate In Excel With Easy Steps

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. It is mainly intended for residents of the US. 10 12 22 24 32 35 and 37.

RapidTax 2020 Tax Calculator Family Income Deductions and Credits Tell us about yourself How will you be filing your tax return. Ad TurboTax Makes It Easy To File Past Years Taxes. Find A One-Stop Option That Fits Your Investment Strategy.

What is the highest tax bracket. Get Started In Your Future. How Income Taxes Are Calculated.

This is 0 of your total income of 0. Taxpayers in the highest bracket. Calculate your income tax bracket 2021 2022.

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. For married filing jointly filers its 0 - 19750. 0 would also be your average tax rate.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. And is based on the tax brackets of 2021 and. 0 Estimates change as we learn more about you Income.

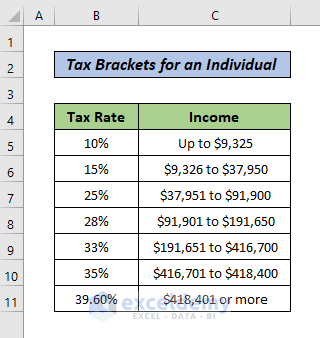

Ad No Stress Property Tax Appeal - Call Now For Guaranteed Tax Savings. There are seven tax brackets for most ordinary income for the 2020 tax year. Your tax bracket is determined by your taxable income and filing status.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. Itemized deductions Standard deductions lower.

If youre filing singly and you have taxable income of 70000 for the year for example you would fall into the 40526 to 86375 income bracket. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Get Started In Your Future.

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. The minimum tax bracket in the US is 10. Single Married Filing Jointly Married.

That means your tax rate would be 22. 2020 federal income tax brackets for taxes due in may 2021 or in october 2021. 2020 Tax Brackets and Tax Rates for filing in 2021 Single.

Over the years I have fine-tuned my Excel spreadsheet to require as little input as necessary especially when it comes to correctly calculate my income tax withholding based. If taxable income is over. And is based on the tax brackets of 2021 and 2022.

Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Your tax bracket depends on your taxable income and your. The new 2018 tax brackets are 10 12 22 24 32 35 and 37.

No Tax Knowledge Needed. 10 of the amount over 0. Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution Ani Globe.

For single filers its 0 - 9875. Find Everything You Need To Quickly Finish Your Past Years Taxes. On this page Which tax rates.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Find A One-Stop Option That Fits Your Investment Strategy. Your Federal taxes are estimated at 0.

Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax.

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

How To Calculate Federal Income Tax

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How To Calculate Federal Tax Rate In Excel With Easy Steps

How To Calculate Foreigner S Income Tax In China China Admissions

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Teachers Income Tax Model Calculation For Ap Telangqana Employees It Calculator Tax Software Teacher Income Income Tax

How To Calculate Income Tax In Excel

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Formula Excel University

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Excel Formula Income Tax Bracket Calculation Exceljet

Inkwiry Federal Income Tax Brackets